I have been on the hunt this year for a new loyalty credit card. I paid off my credit card debt at the end of 2012 and have been watching how various other credit card programs operate before making my final decision. I shared my cost-saving tips on Global News in January when my hunt began.

For now, I am using and paying off my low rate credit card without any rewards (and that’s no fun!).

Beyond credit cards with loyalty rewards, there are also a ton of other store-branded rewards cards (cards that you can only use within a certain store or location) available. Just because your best friend raves about her rewards card does not mean it’s the right one for you and your lifestyle.

Many Canadians feel the same. Which loyalty program is best for them? How do you make the best decision and essentially invest your rewards in a card?

Based on research by Environics Research Group, a free tool was created to help Canadians determine which loyalty program rewards them faster.

While there are many articles and calculators to help you determine which card is best, they are mostly compared on the basis of dividend (in simple terms the value of each point acquired – it breaks down the programs to compare apples to apples). While determining point value is great, it’s not so great if it takes you 10 years to earn enough rewards to actually cash in for something awesome.

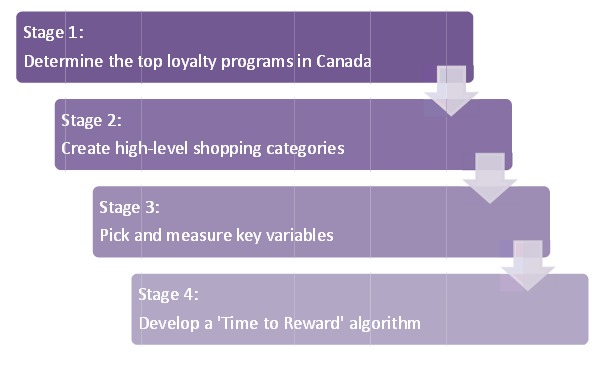

The research conducted, which eventually resulted in compareloyaltyprograms.ca, looked at a “time to reward” tool . Based on your spending habits, how long would it take you to actually earn some great rewards comparing each loyalty program? THIS is where the meat of a program is, people.

The research conducted, which eventually resulted in compareloyaltyprograms.ca, looked at a “time to reward” tool . Based on your spending habits, how long would it take you to actually earn some great rewards comparing each loyalty program? THIS is where the meat of a program is, people.

The website offers Canadians a simple, short survey to determine your personal spending habits and what features you like best in loyalty programs. Then, it uses the tool created to determine which loyalty programs are best for you. Not your best friend. Not your mom.

The research conducted to create the tool is actually quite interesting (especially if you’re a loyalty card fan and deal seeker like me!) so I’d suggest giving it a scroll through as well. Then, take the survey on the site and see if the loyalty program suggested is the one you’re currently using. If it’s not, what does that mean? Are you really getting the best value from your loyalty program?

VERY interesting indeed! Thanks for sharing – I am curious to know if I am using what I should be using for a card!

I use the shoppers optimum mastercard and it does seem to add up faster!

I took the survey and the results match the 2 AirMiles credit cards I have. So I’m doing it right! 😛

I think it might be time to eliminate some of my cards and focus on ones that will yield greater results!

I think I like the shoppers the best

Shoppers and Sobeys. Are the best.

This was a very interesting article and I know it seems Shopper’s points seems to be the best for me

I’ll have to tell the husband..might be worth trying.

My results match my card usage.

Interesting! My results match the cards I use!

shoppers the best

basically it told me I don’t spend enough that it matters but Air Miles should be my pick

2 different Sears cards were in my results. I wouldn’t have thought they would be a good idea. I’m not using the right cards if it’s accurate.

stores with loyalty programs really sucks me in! I took the survey and was matched to Hudson’s Bay Rewards – which I do love!

Im a shoppers fan but am always looking for new rewards

I took the survey and it looks like I am on the right track as I use the rewards program that was suggested.

Ugh – I have too many of these loyalty cards. I’ve got the right credit loyalty though.

I have a sobeys but where I live now there isnt one close, but I do have an momentum visa that gives money back. and air miles card

I’m bad with credit cards but decided I’m going to get only 1. I definitely need to research first.

Great article! I really love the Shopper’s Optimum program 🙂

AddictedtoOPI

So interesting. I am going to check this out right away to make sure I am maximizing my rewards!

I am happy with my PC points MasterCard. I rack up the points pretty quickly there.

I find there are so many product loyalty rewards out there – some better than others – but most of them seem to be a hassle more than anything.

I think Shopper’s Drug Mart is one of my favourite loyalty cards. Some of the cards that I have, I rarely use…I think that some cards are just not worth having.

Thank you for your article on Loyalty Programs – Which One Rewards You Faster?

I have cards for Safeway,Shopper’s Drug Mart And Airmiles.

I don’t use them very often though.

Loyalty programs are really confusing and there’s so much of them. Thanks for the article

This is such a neat tool! I am part of so many loyalty programs, and have been wanting to concentrate on just a few for a while. I’ve put it off because I don’t know how to choose which ones to keep!

Thanks for the post, loyalty programs can be confusing and I am sure I am not making the best use of them. Will have to spend a bit more time figuring them out.

I got air miles for a result. But I love my shoppers optimum card!

I got Sears as the best for me and that’s what I have, also I have Shoppers and I love it. Thanks for this post, it was an eye opener.

I took the survey and it says Air Miles for me, which I use all the time and Sears Master Card. We do try to use cards that offer loyalty programs.

I love the Shoppers Optimum & Sobeys programs. However, the quiz gave me AirMiles, which I do have but only ever use at the LCBO.

This is really interesting and I”m going to look into it further! I’m pretty loyal to my loyalty cards that I have now lol

For me it is Air miles

Without air mile the cost to fly to NB for me is $1000.00

I fly every year. I go to New Brunswich to see my family the cost $266 tax and travel insurance.

1 year my husband came with me to NB and we rented a car for 8 days. Cost $600 included tax, travel insurance and car Rental.

This February I flew to Mexico 7 days all inclusive for $500 for taxes and travel insurance. ( Value was $2000.00).

Plus I just came back from NB

How I do it. I have a Air miles Credit card and not the one with a High fee either.

I pay everything with my credit cards, I pay them off every week.

I pay at the dentist , massage ect…I always get my money back from the insurance before it’s due on the credit card anyway.

I check Safeway great promotions and only buy sale items.

I also get my prescription at Safeway ( Bonus on prescriptions will end soon though)

I gas up at Shell.